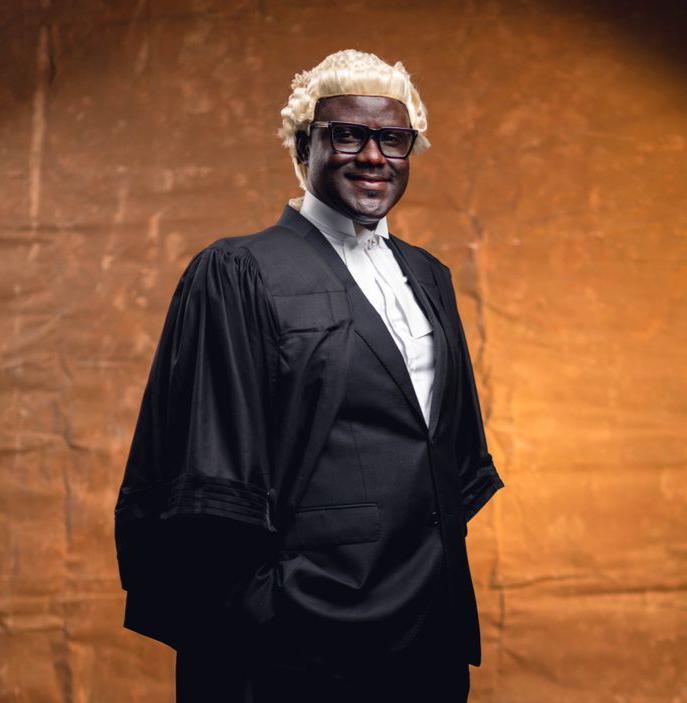

The Managing Director of GCB Bank, Mr Anselm Ray Sowah, has stated that GCB’s strong performance has increased significantly despite the challenges in the banking industry.

He explained that the bank had to deal with challenges as a result of cost hikes and attendant low profit associated with the Purchase and Assumption of two local banks in 2017 – UT Bank and Capital Bank.

Financial Performance

GCB Bank recorded a profit-before-tax (PBT) of GHS450.17 million in 2018 as compared to GHS331.98 million in 2017 making it one of the top three most profitable banks in Ghana for the year 2018.

The increase of 35.6 per cent in profit for the 2018 financial year was largely as a result of a combination of factors like increases in interest income, net trading income and commission and fees as well as stabilised operating expenses.

Mr Sowah stated that GCB Bank has grown into a bigger and better bank with marked profit largely as a result of sound managerial practices, determination of the Board and Management and the commitment of staff.

Strategic Initiatives

Mr Sowah added that as a result of the changing dynamics of the financial services industry driven by intense competition, increased customer demands and technological advancements, GCB Bank embarked on various initiatives aimed at providing enhanced value for clients.

Some of the key initiatives include; the establishment of GCB Custody Services Department to operate as a pension and investment custodians on behalf of fund owners and investors, repositioning of its investment and brokerage subsidiary, procurement of a secured EMV Chip and Pin Card to replace the Magnetic StripCards to ensure increased security.

Other initiatives include the instant issuance of ATM cards, the centralization of back-office operations and digitization of archival records to improve operational efficiency and reduce operational risk and cost.

Strategic Focus

According to Mr Sowah, the strategic focus for 2019, include the optimisation of the electronic banking to provide superior services, remarkable increase in customer service through the deployment of state-of-the-art technology and enhancement of the bank’s human resource.

GCB Bank also aims to introduce mortgage financing and upgrade the GCB Learning Centre to run both internal and external programs.

Source: classfmonline.com