The Bank of Ghana is reportedly engaging banks in the country to help improve their risk management frameworks while the loan loss write-off policy continues.

The move forms part of efforts to help make effective the transmission channel of the Central Bank’s Monetary Policy from the Non-Performing Loans (NPLs) angle.

The Central Bank is also reportedly strengthening credit conditions through the collateral registry and the credit referencing bureaus.

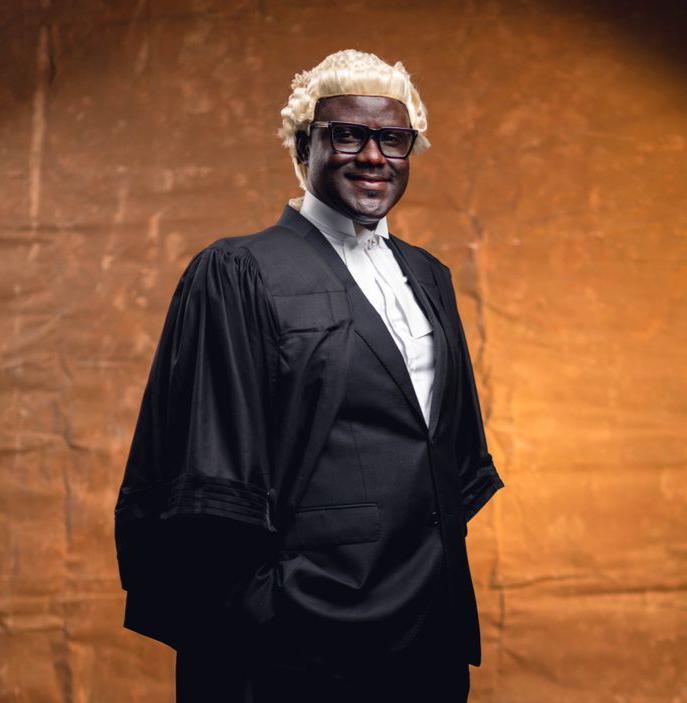

Deputy Governor of the Bank of Ghana, Dr. Maxwell Opoku-Afari, made this known on Thursday, June 13, in Accra, as he delivered a statement on the challenges on Monetary Policy and Markets Development in Ghana at the Ghana-EU Business Forum, saying Banks NPLs still remained high.

The theme for the forum was “Boosting investments for sustainable jobs in Ghana.”

The theme emphasised the forum’s main objective of increasing the awareness of the EU External Investment Plan and in particular its innovative financing instruments in Ghana, and to promote partnerships between International and Local Financial Institutions with potential beneficiaries to promote business opportunities between Ghana and the EU.

According to the First Deputy Governor, the implementation of the Monetary Policy continued to face some challenges in Ghana.

He bemoaned that “as simple as the transmission process may seem, there are challenges.”

According to him, “key challenges to effective monetary policy and markets development, in our experience, have centred mostly on the following: weak and uncompetitive banking sector”

The critical role of banks as the primary conduit for monetary policy, he stated, suggested that the transmission mechanism was more effective in a competitive banking sector environment.

“In a weak and uncompetitive banking sector,” he opined, “monetary policy becomes less ineffective because banks become less responsive to changes in monetary policy stance.”

To address some of these challenges in the Ghanaian economy, the Bank of Ghana, he reiterated, over the past two years, had taken steps to recapitalise and undertaken significant reforms in the banking sector to strengthen the industry’s capacity to effectively intermediate.

The implementation of new and wide-ranging regulatory reforms should also serve to provide a good-enough basis for enhancing competition and efficiency in the sector, he noted.

“Fostering banking competition, efficiency and stability therefore remains

key policy objectives that the Bank of Ghana will continue to pursue to facilitate effective monetary policy transmission,” according to him.

High NPLs

He explained that “the prevalence of high non-performing loans can also limit banks’ lending capacity and/or interfere with policy transmission and therefore impair the effectiveness of monetary policy.”

Although the banking sector’s NPL ratio has declined from 23.5 percent in April 2018 to 18.9 percent in April 2019, according to him, the current ratio still remained very high.

“With such high NPL levels, transmission mechanism of monetary policy to lending rates is weakened and financial intermediation to support economic activity is constrained,” he noted.

Policy Remains Crucial

Meanwhile, he assured that Monetary policy remained and would continue to remain crucial in the macroeconomic management process.

The quest to achieve macroeconomic stability, a necessary condition for sustained growth, cannot be overemphasised, he stated.

Source: dailyguidenetwork.com